Blockchain technology has been hailed as a revolutionary innovation, capable of transforming various industries and providing a new paradigm for secure, decentralized record-keeping. However, as the technology continues to evolve, it has also become clear that blockchains are not a panacea and have several limitations that need to be addressed.

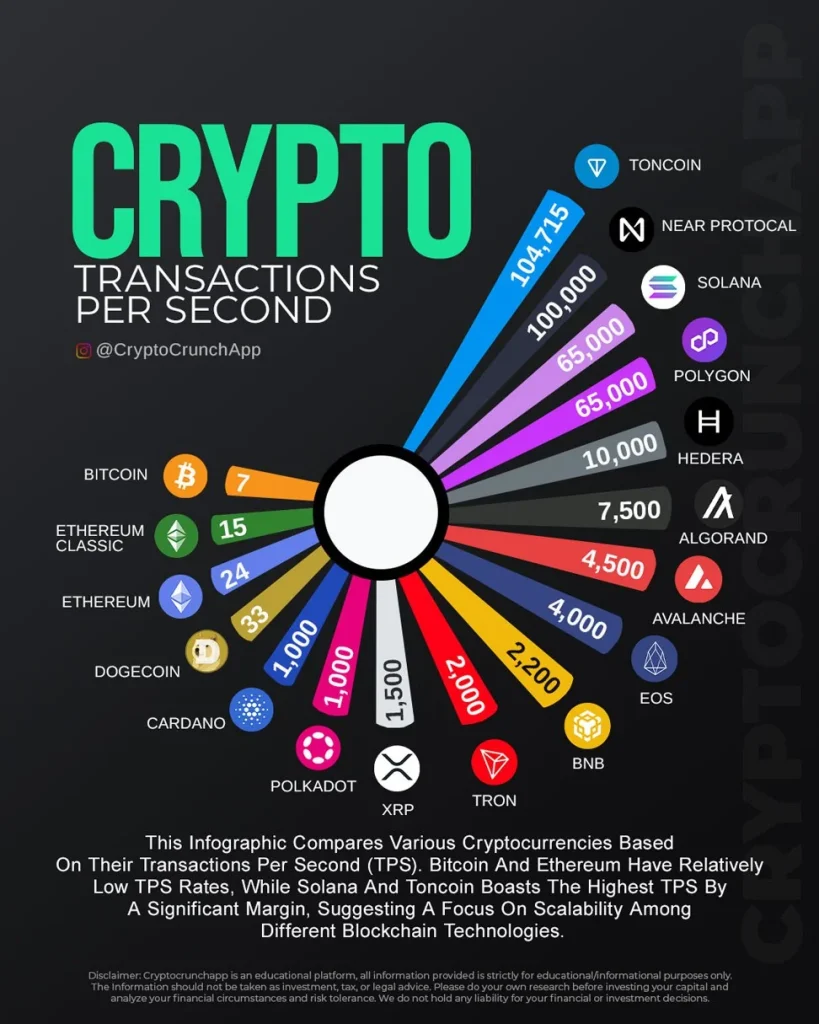

Transaction Throughput and Scalability

One of the primary challenges facing blockchain networks is their limited transaction throughput and scalability. Traditional payment systems, such as Visa or Mastercard, can process thousands of transactions per second, while most blockchain networks struggle to keep up. For example, Bitcoin can only process around 7 transactions per second, and Ethereum can handle around 15 transactions per second. This low throughput can lead to network congestion, longer transaction times, and higher fees, making blockchains less suitable for applications that require high-speed, high-volume transactions.

Addressing the scalability challenge is a significant focus of research and development in the blockchain community. Solutions like sharding, layer-2 scaling, and sidechains are being explored to improve the transaction processing capabilities of blockchain networks. However, achieving true scalability while maintaining the core principles of decentralization and security remains an ongoing challenge.

Privacy Concerns

While blockchains can provide a certain level of privacy, they are often considered less private than traditional financial systems. Transactions on public blockchains are transparent and can potentially be traced back to individual users, raising privacy concerns for some applications. This is particularly problematic for use cases that require a higher degree of confidentiality, such as financial transactions or sensitive data storage.

Efforts to enhance blockchain privacy, such as the use of zero-knowledge proofs, ring signatures, and private sidechains, are being explored, but balancing privacy with the need for transparency and auditability remains a delicate challenge.

Regulatory Compliance

Blockchains may face difficulties in meeting the regulatory requirements commonly found in traditional financial systems and other industries. Regulations such as anti-money laundering (AML) laws, know-your-customer (KYC) rules, and data protection guidelines are often designed for centralized systems and may not fit well with the decentralized nature of blockchains.

Navigating the regulatory landscape and ensuring compliance can be a significant hurdle for blockchain-based applications. Collaboration between blockchain developers, policymakers, and regulatory bodies will be essential to address these challenges and create a more favorable regulatory environment for the technology.

Reversibility and Error Correction

One of the core principles of blockchain technology is the immutability of transactions, which means that transactions recorded on the blockchain are generally irreversible. While this feature can be a strength in certain use cases, it can also be a limitation when dealing with errors or fraudulent activities.

In traditional financial systems, there are often mechanisms in place to reverse or correct erroneous transactions. In the blockchain world, such reversibility is much more challenging, as the distributed and decentralized nature of the network makes it difficult to undo or modify past transactions.

Addressing this limitation will require the development of robust mechanisms for error correction and dispute resolution, while still maintaining the core benefits of blockchain technology, such as decentralization and immutability.

Interoperability Challenges

Blockchain networks often operate in isolation, making it difficult to seamlessly transfer assets or data between different blockchain platforms. This lack of interoperability can limit the potential of blockchain technology to create a truly interconnected, cross-chain ecosystem.

Achieving true interoperability across various blockchain networks is a significant challenge that requires the development of standardized protocols, bridging technologies, and cross-chain communication mechanisms. Ongoing efforts in this area, such as the development of interoperability protocols and decentralized exchange platforms, aim to address this limitation and enable more fluid interactions between different blockchain networks.

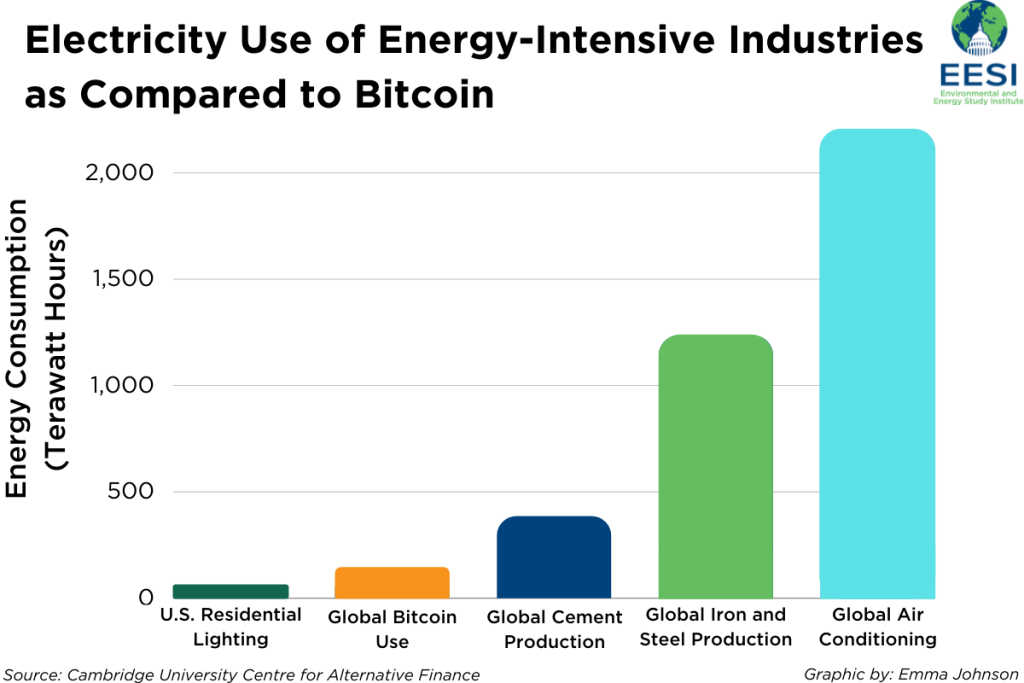

Energy Consumption and Environmental Impact

Some blockchain networks, particularly those that use the energy-intensive proof-of-work consensus mechanism (like Bitcoin), have been criticized for their high energy consumption and potential environmental impact. The computational power required to maintain the blockchain network and validate transactions can lead to significant energy usage, raising concerns about the sustainability of the technology.

As the blockchain ecosystem continues to evolve, alternative consensus mechanisms, such as proof-of-stake and proof-of-authority, are being explored to reduce the energy consumption of blockchain networks. Additionally, the integration of renewable energy sources and the development of more energy-efficient hardware and software solutions may help mitigate the environmental impact of blockchain technology.

Conclusion

While blockchain technology has immense potential, it is essential to recognize and address its limitations. Overcoming challenges related to transaction throughput, scalability, privacy, regulatory compliance, reversibility, interoperability, and energy consumption will be crucial for the widespread adoption and successful integration of blockchain solutions across various industries.

Ongoing research, innovation, and collaboration between developers, policymakers, and industry stakeholders will be necessary to navigate these limitations and unlock the full transformative power of blockchain technology. As the ecosystem continues to evolve, we can expect to see more robust and practical blockchain-based applications that can truly revolutionize the way we store, exchange, and manage data and assets in the digital age.